Ontario, Canada is really a stunning place to stay, work, and check out. It is renowned for its range, organic countryside, and wealthy social HST rebate calculator history. Whether you are a citizen or perhaps a visitor, you may need to calculate your HST refund every now and then. HST (Harmonized Income Income tax) is actually a consumption tax that combines the government Goods and Services Taxation (GST) along with the provincial Ontario Revenue Tax (PST). It is true in Ontario at a rate of 13Percent. Fortunately, in case you are qualified, you may get an HST rebate on a number of your costs. In this particular blog post, we are going to expose you to our HST refund calculator and demonstrate using it for fast estimations.

Exactly what is the HST refund, and who is qualified to receive it?

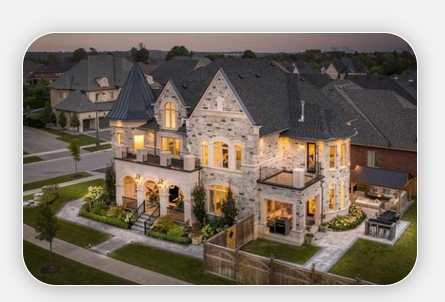

The HST refund is really a refund you could acquire from the government on a number of your qualified expenditures. For example, if you opt for or create a new house, you might be eligible for a an HST refund. Similarly, should you fix up your home, you may also be eligible for an HST refund. On the whole, the HST rebate is accessible to individuals who use products or services for private usage, not for enterprise functions. To claim the HST refund, you should meet up with certain problems, like processing a tax return and having correct documents.

How does the HST refund calculator job?

Our HST rebate calculator is an online device that helps you estimation your HST rebate simply and efficiently. You can use it for a number of purposes, for example purchasing a house, developing a house, or renovating a property. To make use of the calculator, you need to enter in some good information, for example the worth of the house, the time of the transaction, and the particular deal. Once you enter the data, the calculator will show you an estimated refund sum in line with the existing HST rate, your eligibility, and also other factors.

What are the advantages of choosing the HST rebate calculator?

Utilizing the HST rebate calculator has several positive aspects. To begin with, it helps save effort and time by giving you an immediate estimation of your refund. This can be useful when you are planning your financial allowance or evaluating distinct circumstances. Next, it can help you steer clear of mistakes and misconceptions through giving you accurate and dependable information and facts. This could be important when you are handling sophisticated taxes laws and regulations. Thirdly, it gives you satisfaction and self confidence by demonstrating that you are currently on the right course and you are eligible for the rebate.

Just how do you utilize the HST rebate calculator to your benefit?

To make use of the HST rebate calculator to your advantage, you should stick to some best techniques. Firstly, you want to ensure that you have all the essential information and documentation prior to starting the working out. This can include your statements, statements, and contracts. Secondly, you must twice-check your inputs and outputs to make certain that they are proper and steady. This can include confirming your computer data and computing your estimations manually or with an additional resource. Thirdly, you should seek professional advice or help when you have any concerns or worries relating to your eligibility, taxation planning, or some other associated concerns.

brief:

In a nutshell, Ontario, Canada gives several possibilities for individuals to assert HST rebates on his or her qualified expenses. Employing our HST refund calculator can help you quote your probable refund swiftly, effortlessly and precisely. Following the very best procedures and trying to find professional suggestions, it is possible to improve your refund and reduce your taxes problem. We hope that you have located this blog article informative and useful. If you have any comments, inquiries, or tips, remember to you can call us. Many thanks for studying.